Non-interest income fuels the revenue growth of many banks, and merchant services represent a potentially lucrative channel. Whether your bank already provides merchant services or not, the same pivotal question lingers:

How much demand exists within our customer base for merchant services?

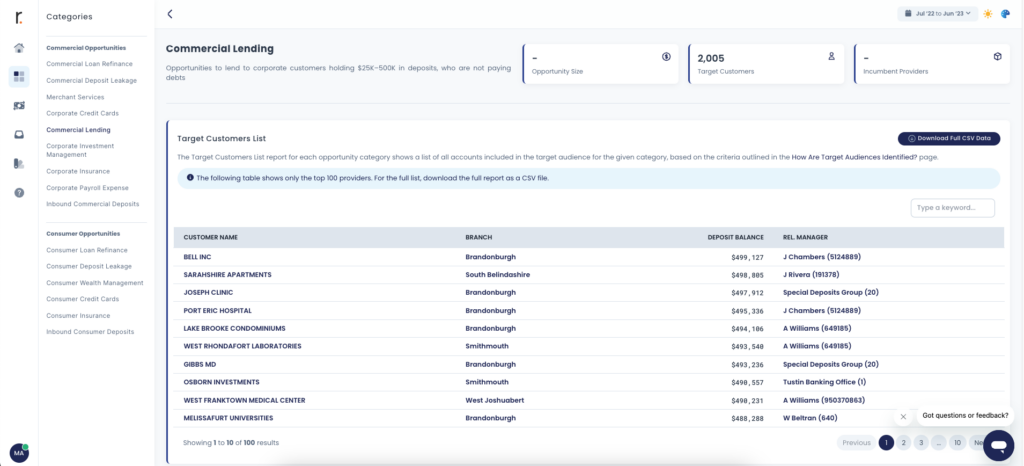

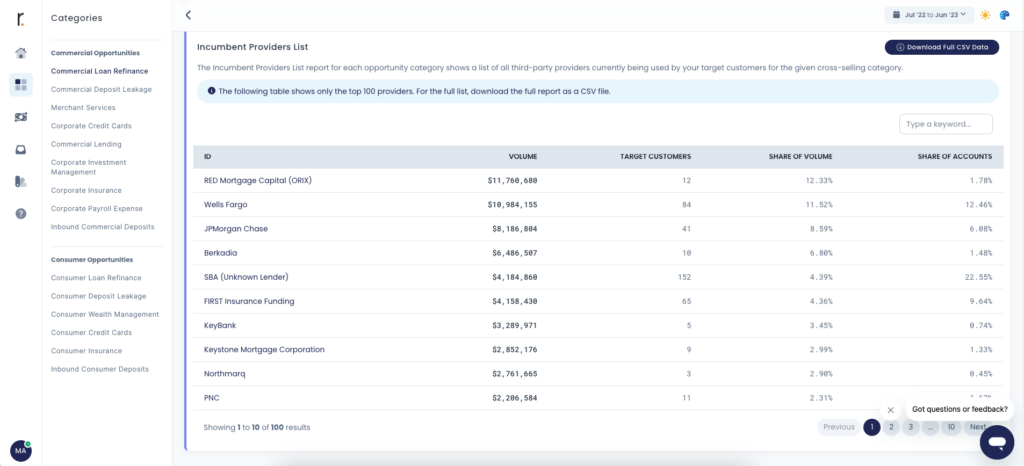

For banks currently offering merchant services, understanding untapped demand is a game-changer. You can strategically optimize your offering and prudently invest in growth initiatives. Key considerations like how your service compares to competitors that your customers currently use, and identifying the highest-value customers can drive ROI on your outreach and marketing campaigns.

Meanwhile, banks not yet offering merchant services can leverage this understanding to confidently chart a strategic path. Should you consider offering merchant services? If so, which competitors’ features and benefits should you outperform to win your commercial depositors’ business? What go-to-market strategies will drive the most adoption? Without data-driven answers, you may be missing out or taking a leap of faith by entering this market.

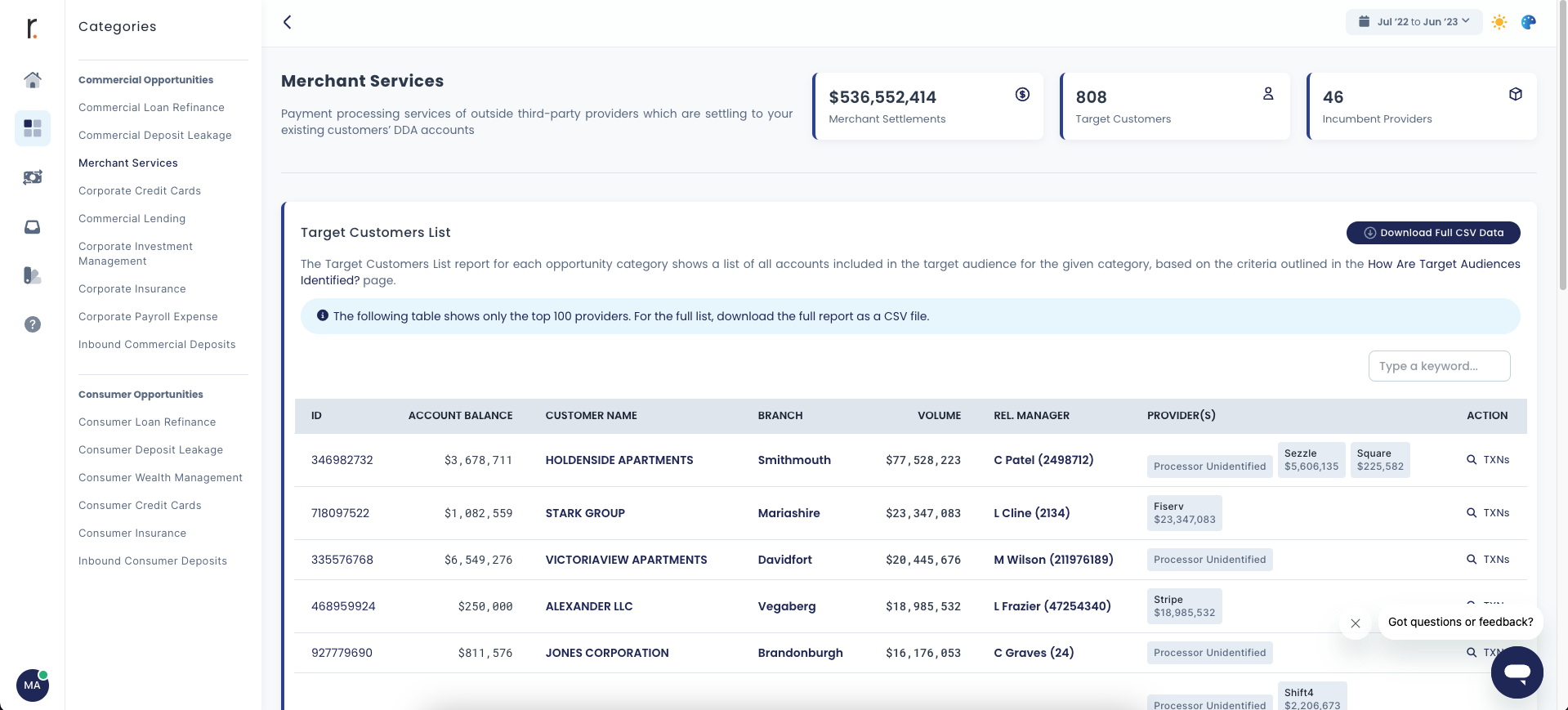

Revio’s Opportunity Report for Merchant Services provides these answers quickly and intuitively. You’ll see the total annual volume of merchant services settlements coming into your commercial depositors’ accounts from outside providers—broken down by both account and incumbent provider.

Equipped with this data-driven insight, you can enhance your merchant services offering, invest in targeted customer outreach, seize the highest-value opportunities, and grow your non-interest income. With Revio, precision trumps guesswork.