To grow non-interest income, many banks strive to offer comprehensive wealth management services, either through their own dedicated teams or by partnering with external providers. But the million-dollar question remains: how do we identify which of our depositors could significantly benefit from these wealth management services? Do we segment by demographics or merely sift through the highest deposit-account balances? These approaches will yield noisy results, at best. Is there a better way?

There’s a popular saying: “If you want to know a person’s priorities, look at how they spend their money.” The sentiment is cliché, but valid. After all, allocating our finite resources towards something is a clear demonstration of interest and commitment. When quantifying this interest in financial terms, there’s no better tool than Revio’s platform.

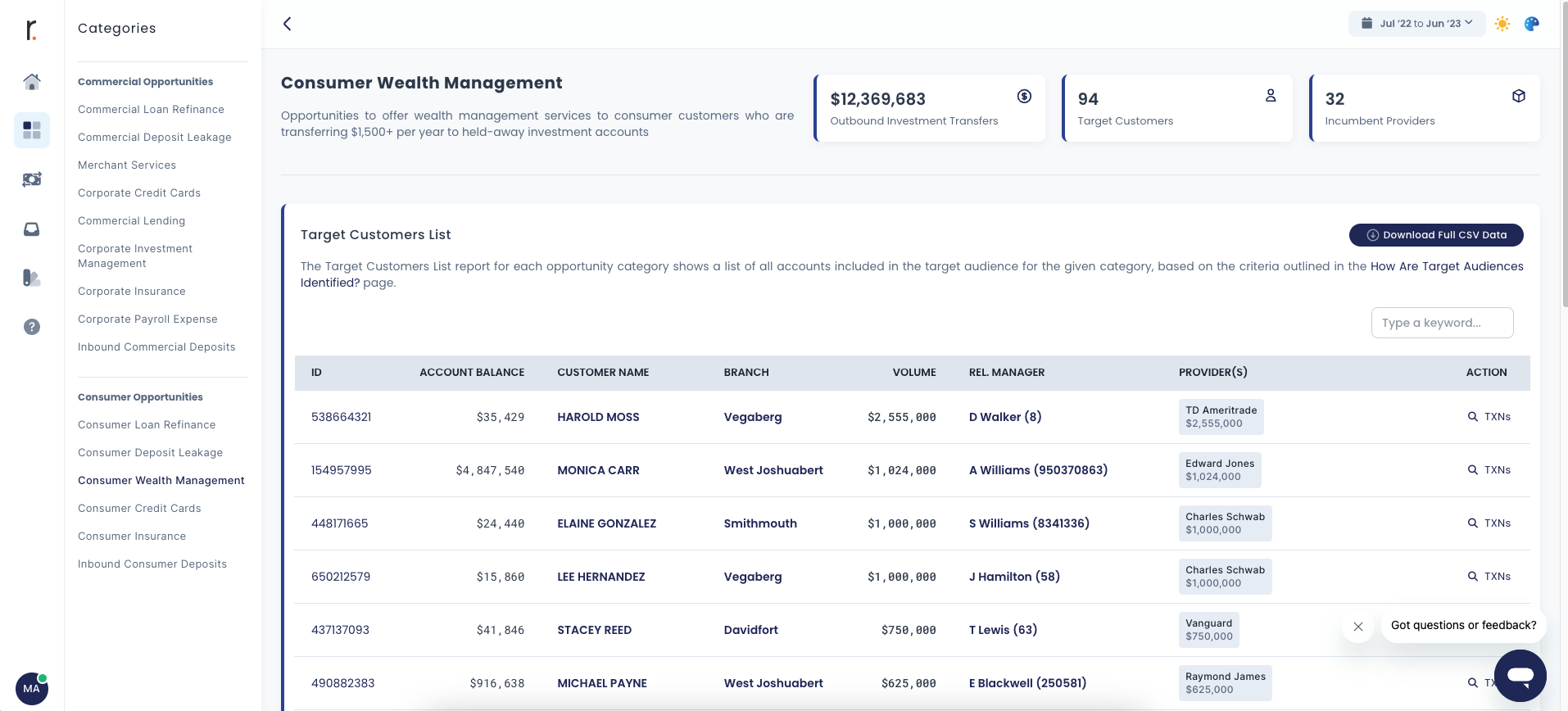

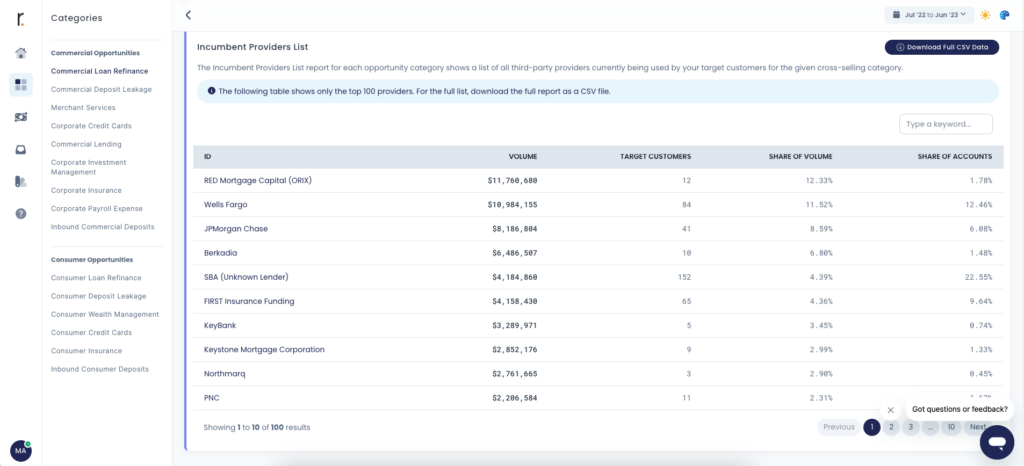

With Revio, all your potential wealth management clients are viewable on a single screen. Our platform identifies opportunities by tracking outbound transfers to third-party investment platforms, spotlighting your most proactive investor-customers. Isn’t this the most direct measure of their appetite for wealth management services?

The opportunities that Revio pinpoints are based on new investment dollars allocated over the past 12 months. Consequently, the total assets under management (AUM) for each customer are likely to be considerably larger. Winning one of these opportunities often means a substantial growth in your wealth management practice’s AUM, often exceeding the client’s new investments from the previous year.

The operation is as straightforward as it gets: cherry-pick the opportunities you want your sales team to pursue, export them as a call sheet or a structured CRM import, and watch your team engage your highest-value customers, offering them the wealth management services they truly deserve.