As a savvy banking executive, you’re constantly asking, “Which of my commercial customers could benefit from our tailored financing products, accelerating their growth?”

Traditional query-based reporting provides a long list of commercial depositors not currently borrowing from your bank. But, let’s face it, not all leads are created equal. This list likely includes customers burdened with debt at other institutions or smaller businesses not yet primed to borrow. Sifting through these prospects can be time-consuming and often yield limited results.

So, how can you streamline this process, zeroing in on the prospects that matter? Enter Revio.

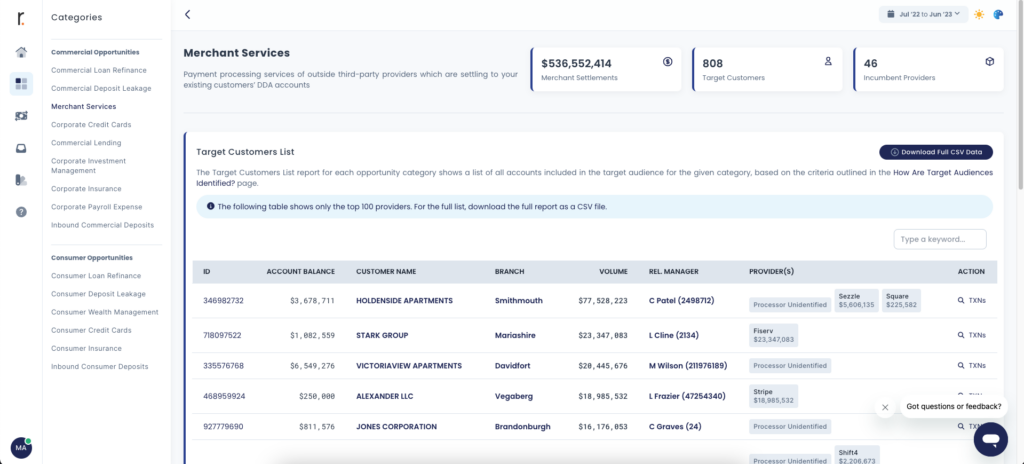

Our proprietary analytics platform intelligently decodes transactions where funds enter or leave your bank, providing a refined, actionable list of commercial lending leads.

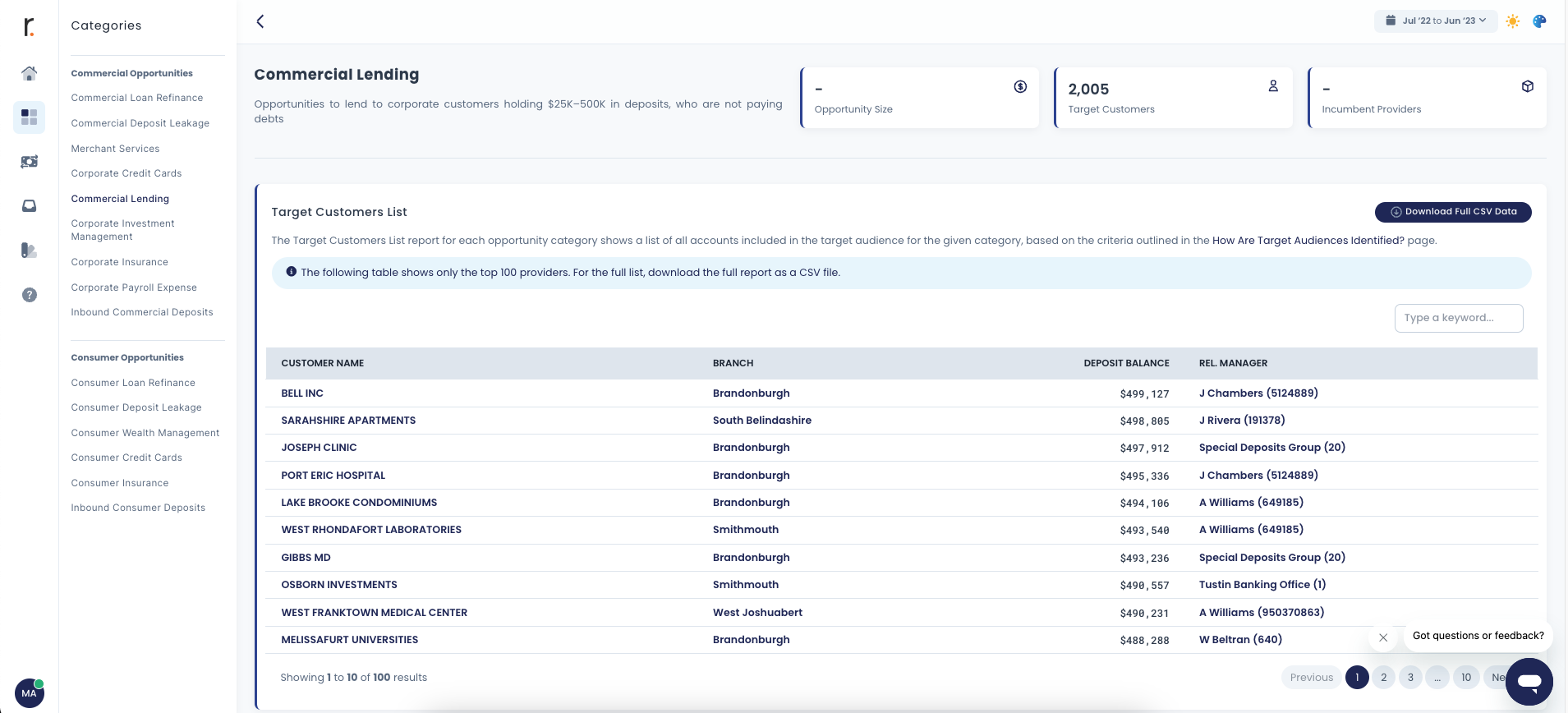

With Revio’s Commercial Lending report, you discover Target Accounts belonging to commercial customers with a deposit balance of $25K–500K. These are customers who are not paying any debts — either within your institution or elsewhere. You’re left with a curated list of well-capitalized commercial clients who aren’t yet leveraging borrowing to fuel their business growth.

Unlocking more revenue requires strategic conversations with your customers. With Revio, you pinpoint your most promising cross-selling opportunities, enabling your team to smartly invest their outreach efforts. Amplify your interest income and drive your bank’s growth with Revio!