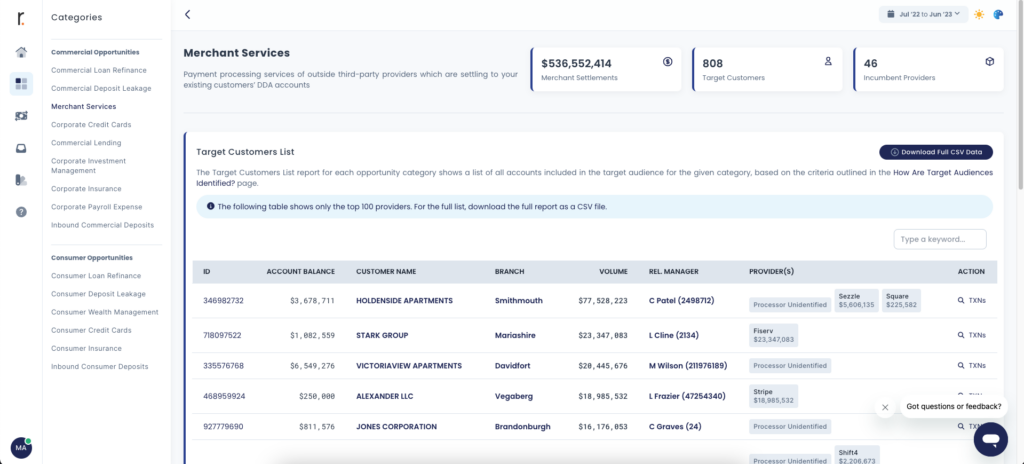

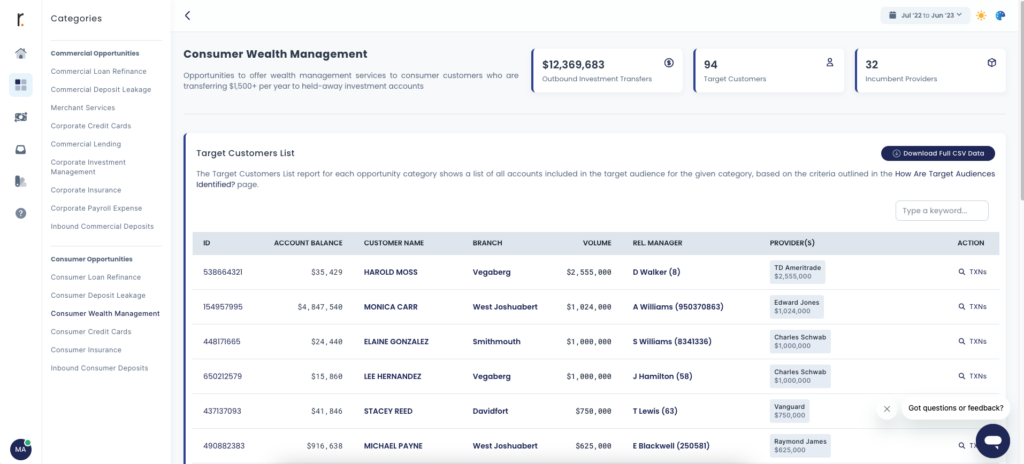

No longer do banking customers limit themselves to one bank for all their financial affairs. Your customers have an ocean of choices — from the community bank next door or large national banks, to new fintech startups. To expand your product adoption and earn more business from your existing customers, you need to outpace the providers your customers are currently favoring. However, competing against every provider on every front in every category isn’t feasible. You have to strategically narrow your competitive focus.

Historically, banks have relied on wide-reaching industry statistics or gut instincts to shape their competitive strategies. But wouldn’t direct, customer-specific data revealing your actual competition be more valuable? The good news is, this critical data resides in your core processing system — and Revio can unlock it, offering you vital insights about your competition.

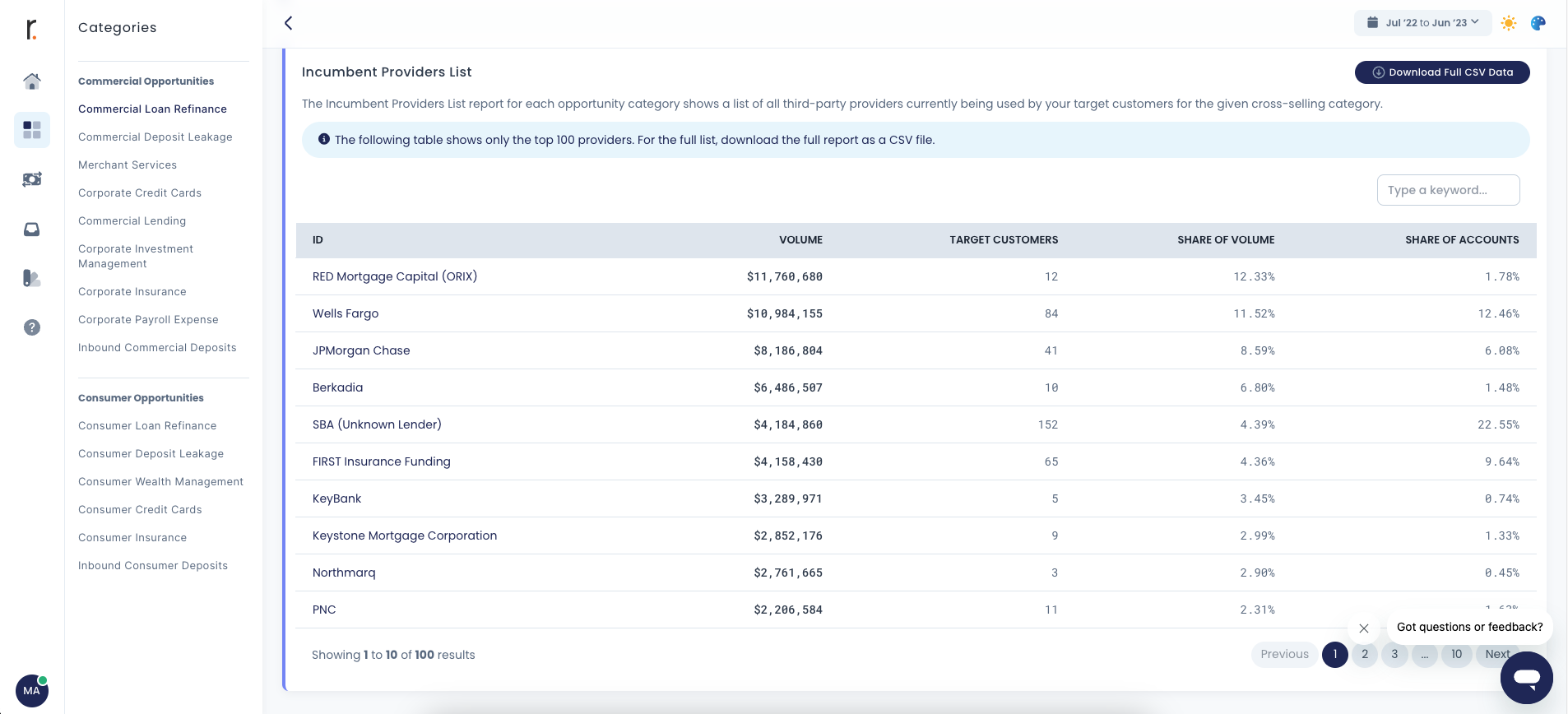

Consider commercial lending, for instance. Revio dissects the payments your commercial depositors make to external debts by lender, showcasing a leaderboard of providers based on the yearly dollar volume of payments your customers make. Moreover, you can view each competitor’s share of payment volume and account distribution.

As you navigate through the list and come across unknown competitors, a straightforward click whisks you off to the provider’s website, transforming the laborious task of competitive research into a cinch.

Are you tired of speculating about your competition? If you’re ready to know with certainty, you’re ready for Revio.