You got the loan.

They got the rest.

Most banks and credit unions capture only about half of the financial lives of their customers and members, losing the rest to competitors.

Deepening existing relationships is one of the biggest growth opportunities on the table. Don’t settle for being the Backup Bank or Casual Credit Union. Earn the full relationship.

Reveal the competition.

Capture the opportunity.

Revio Insight transforms raw transaction data into competitive intelligence, showing you where to take action.

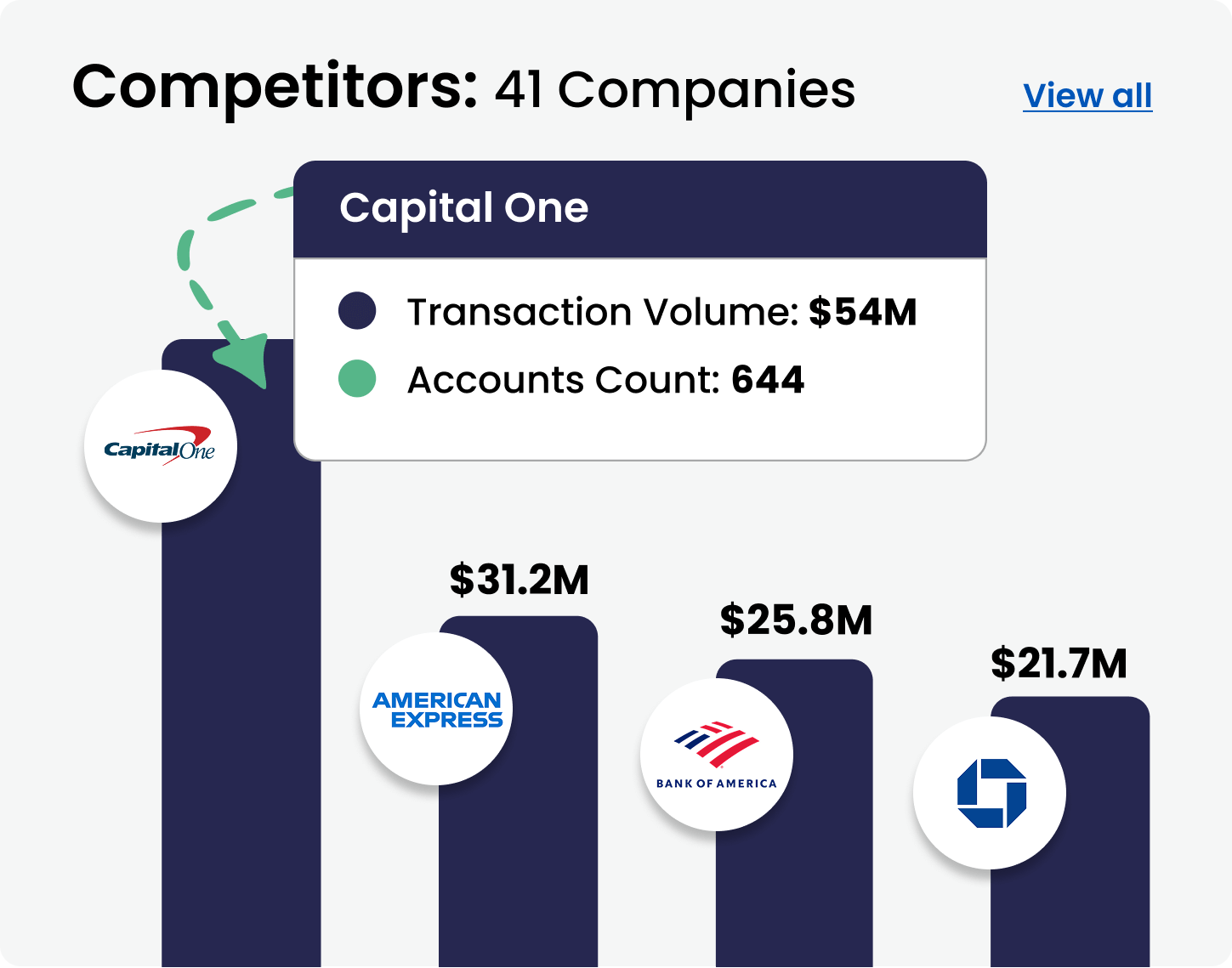

Detect deposits slipping away, and see the competitors that receive them.

Uncover which competitor products your customers or members already use.

Focus your teams on the biggest revenue opportunities and stop making them cross-sell in the dark.

Easy to launch.

Simple to scale.

Revio Insight plugs into your existing systems, goes live in months—not years—and makes competitive insights accessible to everyone who needs them.

We play well with others.

Integrations shouldn’t be a project. With our partners, we can surface insights where your teams already work.

We play well with others.

Integrations shouldn’t be a project. With our partners, we can surface insights where your teams already work.